World's cities are paved with opportunity

For brands looking to expand, whether overseas or in domestic markets, a city-centric marketing strategy is proving effective as it helps cut risk and costs while capitalising the wealth being generated in those areas.

If Tokyo were a country, it would outrank Spain in a list of the world’s largest economies. Similarly, London’s gross domestic product is greater than those of both Sweden and Switzerland. As the world’s population flocks to urban centres, brands are not building global businesses country by country, but city by city.

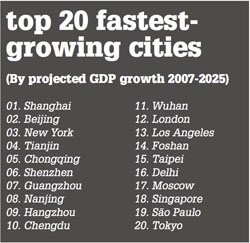

Half the world’s people live in cities. By 2050, that figure will be two-thirds, according to the United Nations. Data from management consultancy McKinsey also suggests that cities generate 80 per cent of the world’s wealth, a figure that is only likely to increase as emerging countries such as China, India and Brazil rapidly become industrialised. Most of the world’s fastest-growing cities will be in developing markets.

In response to these trends, global drinks company Diageo, owner of brands such as Guinness and Johnnie Walker, applies a city-centric strategy to its international marketing. Diageo analyses and targets cities that are a good fit for the business objectives of its individual brands, using a method devised by its strategy consultancy Cognosis.

David Gates, global category director for Diageo’s whiskies, says this allows the brand to ensure its product distribution and marketing investment are focused in a geographical area with a high concentration of target consumers.

“City-centric campaigns allow a brand to get scale with pace within a tight consumer demographic, and also to develop valuable insights and learning as a result. We find it works particularly well for our premium spirit brands, with their natural skew to urban and sophisticated consumers,” he says.

Diageo’s approach not only takes into account consumer demographics within a city but also uses a variety of publicly available information to create a picture of how well suited the city will be to a given brand. This can be adapted for virtually any type of product. For example, an Italian clothing label seeking to reach fashion-conscious consumers could use several measures to indicate whether those people can be found in a particular city. If that city contained a large number of British and Italian expatriates, this would indicate a high probability of a demand for fashion, according to the Cognosis method.

Prevalent fashion and design schools within the city would also show that it attracts people who have a passion for the subject. If the city hosts ‘fashion week’ events, it is likely to be home to trendsetters; and the presence of Illy coffee shops suggests a liking for the Italian lifestyle.

Diageo has previously used similar data to assess the potential of cities for its products. In one case, Diageo wanted to target the distribution of an ultra-premium spirit to a small group of upmarket consumers, in order to generate the best possible sales value from a very limited supply. The company had been considering Russia, but after performing a city analysis, settled on Melbourne and Sydney instead. Australia had not previously been in the reckoning.

Understanding the cultural life of cities is particularly important for brands expanding into new markets, according to Burton’s Biscuits chief commercial officer Steve Newiss. He says a foreign product is likely to come up against stiff competition from established local brands, so plotting the wrong route into a market could be an expensive waste of time. The UK-based maker of Wagon Wheels and Jammie Dodgers is expanding in China, having started in Shanghai.

Newiss says: “It’s difficult, because there is plenty of local manufacturing providing local products for local people in a local way. You’ve got to go to where people want something different and that tends to lead you to the big cities, and to premium stores. Big cities are culturally different too. There’s multinational behaviour - Shanghai is a melting pot but go to Wuhan and it is all very local.”

This does not necessarily mean that a non-Chinese brand will do better in Shanghai than it will in Wuhan but it does mean that different cities’ distinctive cultures can lead them to be better or worse fits for foreign-owned companies. Dusit International group director of development Rustom Vickers says this is particularly true for its hotel brands (see Q&A[1]).

Dusit’s brand is based on a Thai view of hospitality. This positioning is used in new markets to a greater or lesser extent, depending on how receptive those destinations are and how likely it is that prospective hotel guests would want their experience to mirror the host city as opposed to the brand’s Thai values. In some cities, Vickers admits, “that culture is a clash”.

But even as brands expand within their home markets, where cities might not have such divergent cultures compared with the variation that exists around the globe, marketers are considering targeting urban areas individually. Mobile phone operator EE, formerly known as Everything Everywhere, has made this apparent with the initial roll-out of its new 4G data network to 11 UK cities.

Director of brand Spencer McHugh says that in EE’s ads each city has received “its own executions and copy that talks to that city” (see case study[2]).

Although EE could have waited until its 4G infrastructure was capable of rolling out across the whole of the UK simultaneously, it decided that selling its service in a small number of cities first would be more valuable. This is partly because it will be able to offer 4G exclusively to urban dwellers for at least six months before competing mobile networks get their own services up and running. EE has taken a calculated gamble, but one that recognises the importance of marketing to city populations.

EE is not alone in adopting a city-centric marketing strategy for reasons of infrastructure. It is now often a determining factor in how brands expand, especially internationally, whether the infrastructure belongs to the brand, the companies it deals with, or the cities and countries where it does business. Many of the world’s developing countries are very large or have urban centres that are far apart with poor transport links, restricting how fast and far companies can extend their reach to new consumers.

Weetabix has come up with a novel way of bridging the rural gaps between cities by using bicycles. In Kenya, distributing small volumes of its products by bike has allowed the company to become the market-leading breakfast cereal maker.

Chief executive Giles Turrell says: “Because we understand the market and we use a bicycle sales force to get into all the little stores, we have the best distribution, as well as being in the supermarkets where they exist in the big cities like Nairobi.”

Weetabix’s model is probably atypical of most international consumer goods brands, however, and is unlikely to work everywhere. If the business is one that relies on distribution through physical networks that need to be close to consumers - for example stores or restaurants - then geography often becomes a limiting factor, and city by city is the only way to grow.

Just Eat, the takeaway food website that acts as a portal for placing orders to thousands of restaurants, operates in 13 countries and aims to add as many vendors as it can to its network. Its expansion is influenced by the numbers and types of restaurants in each location and their distance from the consumers that would use them. Outside the UK, it is mainly confined to city locations because that is where most of its partner restaurant businesses are based.

Head of global insight Paul Cook says that the physical restaurant network means his online business cannot grow like a purely web-based operation, where the only geographical concerns are about delivery locations.

“We are bound by the restrictions of where the restaurants are,” he says. “Someone like [online retailer] Play.com isn’t, because anyone that can order through the internet can have their product delivered. We don’t have that same dynamic.”

This issue is particularly prevalent for Just Eat in geographically large countries such as Brazil, where it operates as Restaurante Web, and Canada. The company has entered both markets within the past 12 months and prioritises areas where takeaway food is popular.

The same concerns have put off Just Eat from entering the US for the time being. Cook explains: “We’ve got the issue with the US that suddenly you’re not talking about total coverage. You would be looking only at key cities, because geographically we have the same barriers. I wouldn’t say it’s because of the sophistication of Americans’ palettes but there are swathes of the States where takeaway food across different cultures is not as readily adopted.”

A similar, less open attitude towards unfamiliar products outside the main cities is why Burton’s Biscuits is taking its Chinese expansion slowly. It is aware that until demand for international products spreads outside urban areas, the brand would have to spend heavily on marketing for a low level of impact.

Burton’s Biscuits’ Newiss says: “What we’ve found in China is that the city-by-city model is what we want to do, because you can disappear in China. You can spread yourself too thin. Our international strategy is about partnership, and one of the big things is finding the right partner.”

Partnership with local operators is one way of guaranteeing that a plan for growth into new cities is guided by local knowledge, as opposed to wishful thinking from centralised brand managers, who may know what they want from expansion but probably know less about how to get it. At Burton’s, these partnerships take the form of appointing a master distributor in a city, which the company depends on for making wholesaling decisions in the surrounding area.

Newiss says that Burton’s must balance its priorities for maintaining the integrity of its brands with the willingness to adapt to the needs of the local market. “We are not bastardising the brand concept, but we are being locally relevant,” he argues.

Dusit International similarly takes local advice when opening hotels in unfamiliar markets, since finance and labour practices vary. It uses different business models depending on what makes most sense. The company owns hotels, operates some on behalf of their owners and runs others as joint ventures, but in most cases local developers will provide insight into the chosen city.

The level of Dusit’s control over adapting design and management to the local market can vary, says Vickers, especially if the company is taking on the management contract from another party.

“It depends on the status of the project when we become involved, and how advanced it is. Ideally, if it is well planned, we should arrive at the beginning, and that is normally what would happen. But sometimes, we arrive mid-way through so support then comes from the corporate office here in Bangkok,” he says.

As Dusit’s example suggests, the adoption of a city-centric approach to marketing and overall business growth poses many questions about the most effective way to manage international brand expansion. As more companies plot to grow city by city, brand management structures are likely to need to change.

Centralised marketing operations may need to devolve some control to brand managers on the ground in key urban markets. With major international cities sharing traits with each other, it seems certain that more brands will be using this method of expansion in future.

References

- ^ see Q&A (www.marketingweek.co.uk)

- ^ see case study (www.marketingweek.co.uk)